NEXANS (EPA:NEX): The Electrification Pure Player at the Nexus of the Global Grid Supercycle

The vertical integrated Compounder in the Age of Electricity

This Deep Dive is also available via. Podcast.

Investment Theory / Management Summary

In the often hyper-speculative theater of global equities, where narratives frequently outpace fundamentals, Nexans (EPA:NEX) emerges not merely as an industrial manufacturer, but as a disciplined capital allocator disguised as a cable company. For the sober observer of financial history, the transformation of Nexans from a sprawling, volume-obsessed conglomerate into a lean, “Electrification Pure Player” represents one of the most compelling corporate turnarounds in the European industrial sector over the last decade. The company has effectively shed its skin, transitioning from a generalist wire drawer into a critical infrastructure architect for the “Age of Electricity,” creating a high-conviction investment case for the patient accumulator of value.

The core investment theory rests on a trifecta of structural tailwinds, operational rigor, and a strategic pivot that is now yielding quantifiable value. We are witnessing the genesis of a “Flywheel” effect driven by the proprietary “E3” management model—Economy, Environment, and Engagement. Unlike the often vacuous ESG pledges that saturate contemporary annual reports, Nexans has weaponized sustainability as a precise tool for margin expansion. By ruthlessly culling low-margin customers and SKUs based on their return on carbon employed, the firm has structurally elevated its Return on Capital Employed (ROCE) from a pedestrian single-digit percentage to a robust 21.6% in the first half of 2025.1 This is not merely an operational cleanup; it is a fundamental rewriting of the company’s economic DNA.

Nexans is now a “Compounder” operating within a supply-constrained “Spawner” model. Having successfully shed its dead weight—most recently through the divestment of AmerCable in early 2025 and the spin-off of the industrial harnesses business, Lynxeo—the company is redeploying capital into high-return assets like the Nexans Electra vessel and expanded Halden facilities.1 The “Spawner” characteristic is evident in its ability to incubate and grow high-margin segments like PWR-Transmission (subsea high-voltage), which now boasts an adjusted backlog of €7.9 billion as of September 2025.3

The macro-environment provides a tailwind of rare magnitude. The world is entering a supercycle of grid modernization, offshore wind expansion, and cross-border interconnection. The International Energy Agency (IEA) projects global energy investment to reach $3.3 trillion in 2025, with clean technologies accounting for two-thirds of this total.4 Yet, the supply chain for high-voltage direct current (HVDC) subsea cables—the arteries of this transition—is constrained by a formidable oligopoly.

Nexans, alongside Prysmian and NKT, sits behind a high barrier to entry, protected by technological complexity, capital intensity, and a scarcity of cable-laying vessels.

However, the investment case is not without its “Wall of Worry.” The abrupt leadership transition in October 2025, seeing the architect of this turnaround, Christopher Guérin, hand over the reins to Julien Hueber, introduces a layer of execution risk.5

Furthermore, the geopolitical quagmire surrounding the Great Sea Interconnector (GSI) project—with tender cancellations and denials of “Plan B”—serves as a stark reminder of the complexities inherent in mega-infrastructure projects.6 Nevertheless, the financial data speaks with a clarity that overrides narrative noise. With Adjusted EBITDA reaching record highs of €804 million in 2024 and net debt aggressively managed down to near-zero levels before strategic acquisitions, Nexans presents a compelling case for the sober investor.7

The Thesis: An Oligopolistic Moat in a Supply-Constrained World

The central pillar of the Nexans thesis is the existence of a widening economic moat in the high-voltage subsea cable market. This moat is not merely a function of market share but is built upon extreme complexity, capital intensity, and the physics of electricity transmission in hostile environments.

The Technological and Asset Moat

The high-voltage (HV) and ultra-high-voltage (UHV) cable market is not a playground for new entrants or commoditized competition. The barriers to entry are multifaceted and formidable, creating a protective enclosure around incumbent profitability.

First, the technological pedigree required to manufacture 525kV HVDC mass-impregnated or XLPE (Cross-linked Polyethylene) subsea cables is immense. These cables must withstand extreme pressure, saltwater corrosion, and mechanical stress while transmitting gigawatts of power over hundreds of kilometers without electrical breakdown. Nexans holds a technological edge, demonstrated by its world records in cable depth and length, and its capability to execute complex projects like the Celtic Interconnector.8 This expertise is the result of decades of material science accumulation, creating a “knowledge moat” that cannot be easily replicated by capital alone.

Source: Celtic Interconnector

Second, the asset intensity required to compete at the highest level serves as a significant deterrent. The “assets” here are not just factories, but the integrated capability to manufacture, transport, and install. The construction of the Nexans Aurora and the upcoming Nexans Electra (scheduled for delivery in 2026) creates a closed-loop delivery system.10 These state-of-the-art cable-laying vessels are scarce assets; the global fleet is currently insufficient to meet the projected demand for offshore wind and interconnectors.11 The cost and lead time (3-4 years) to build such vessels and the specialized factories required (like the expanded Halden plant in Norway) constitute a capital barrier that shields Nexans from rapid competitive encroachment.

Third, “bankability” is a critical, often overlooked moat. Transmission System Operators (TSOs) like TenneT, RTE, and EirGrid do not award billion-euro contracts to unproven entities. The cost of cable failure is catastrophic, potentially costing millions in lost revenue per day for a grid operator. Nexans’ history, tracing back to 1879, provides the “bankability” required for project financing.12 Financial institutions and insurers require proven track records to underwrite these massive infrastructure projects, effectively locking out new or smaller players.

The Rational Oligopoly

The global market for high-end subsea power cables has consolidated into a rational oligopoly comprising three primary European players: Prysmian, Nexans, and NKT. Analysis of market data for 2025 indicates these three firms control a dominant portion of the European and North American high-voltage market.13

This market structure has shifted the competitive dynamic from price wars to capacity reservation. TSOs are now paying to reserve manufacturing slots years in advance, a dynamic that fundamentally shifts leverage from the buyer to the manufacturer. This “capacity reservation” model ensures better visibility on revenue, improved payment terms, and protection against raw material inflation. For instance, Nexans secured a major framework agreement with RTE valued at more than €1 billion in March 2025, underscoring this trend of long-term partnership over transactional bidding.15

The Strategic “Pure Player” Pivot

The thesis is further strengthened by Nexans’ strategic purification. The company has systematically divested cyclical, lower-margin businesses to focus entirely on the electrification megatrend.

Divestments: The sale of the Telecom Systems business in 2023, the disposal of AmerCable in early 2025, and the spin-off of the industrial harnesses business (Lynxeo) in mid-2025 have eliminated significant drag on ROIC.1

Acquisitions: Concurrently, Nexans has acquired high-value assets like La Triveneta Cavi (June 2024) and Electro Cables in Canada (October 2025).1 These acquisitions bolster the PWR-Connect segment, adding density and synergies in key geographies.

This portfolio rotation has reduced the conglomerate discount often applied to industrial firms and sharpened the valuation multiple. Nexans is no longer a proxy for general industrial activity; it is a pure-play derivative of the global energy transition.

Sector and Macro Analysis: The Great Electrification Supercycle

To fully appreciate the investment case for Nexans, one must understand the magnitude of the macroeconomic currents propelling the electrical infrastructure sector. We are not merely observing a cyclical upswing; we are in the early stages of a multi-decade capital expenditure boom—a “Supercycle” of electrification.

The “Age of Electricity”

The International Energy Agency (IEA) has termed this era the “Age of Electricity.”

The IEA Electricity 2025, Analysis and Forecast to 2027 is a Deep Dive by it’s own and can be viewed here.

Global energy investment is set to reach $3.3 trillion in 2025, with clean technologies accounting for two-thirds of this total.4 Electricity demand is rising twice as fast as overall energy demand, driven by three simultaneous revolutions:

Data Centers and AI: The exponential growth of Artificial Intelligence requires massive data center capacity, which in turn demands reliable, high-power connections.

Electric Vehicles (EVs): The electrification of transport is increasing load on distribution grids (PWR-Grid), necessitating upgrades and reinforcement.

Heat Pumps and Industrial Electrification: The shift away from fossil fuels for heating and industrial processes is driving further electricity consumption.16

The Grid Bottleneck

The electrical grid has become the primary bottleneck for the energy transition. In 2024, over 1,650 GW of renewable projects—solar and wind—were stuck in interconnection queues, waiting for grid access.17 To meet climate goals, the world must add or refurbish over 80 million kilometers of grids by 2040.

This bottleneck creates a sense of urgency among governments and regulators. The European Union’s “Grid Action Plan” and similar initiatives in North America are unlocking funding and streamlining permitting processes. Grid investment has historically lagged behind generation investment, but this is now correcting. IEA data suggests grid investment needs to double to over $600 billion annually by 2030 to remain on track.18 Nexans, with its PWR-Grid and PWR-Transmission segments, sits directly at the intersection of this capital flood.

The HVDC Supply Crunch

The most acute imbalance exists in the HVDC subsea cable market. Offshore wind farms are moving further from shore to capture stronger winds, necessitating DC transmission to minimize electrical losses over long distances. Furthermore, interconnectors like the Celtic Interconnector (linking Ireland and France) are crucial for regional energy security and price arbitrage.9

Market analysis suggests a structural deficit in cable manufacturing and installation vessel capacity emerging by 2026-2027. Demand for subsea cables is forecast to grow at a 19% CAGR through 2030, yet lead times for new factories are 3-4 years.19 This supply-demand mismatch grants incumbents like Nexans significant pricing power. They can afford to be selective, choosing projects with the best risk-adjusted returns—a strategy Nexans explicitly pursues under its “margin over volume” mantra.7

Copper Dynamics: The Physical Constraint

Copper is the physical constraint of the electrification thesis. It is the conductive metal upon which the entire energy transition relies. Forecasts indicate a structural deficit emerging by 2026 due to declining ore grades, lack of new mines, and the long lead times (10+ years) to bring new supply online.21

While Nexans passes through metal costs to customers (the “pass-through” mechanism protects margins from price volatility), physical availability is a strategic risk. If there is no copper, there is no cable. Nexans mitigates this via its vertical integration. It owns a copper rod mill in Montreal and has established strategic sourcing agreements.

Source: Copper rod mill in Montreal

Furthermore, its focus on recycling through its RecyCâbles joint venture allows it to reclaim copper, providing a partial hedge against physical scarcity.12 The company aims to increase recycled copper content to 25% by 2028, a strategic imperative that also aligns with its environmental goals.7

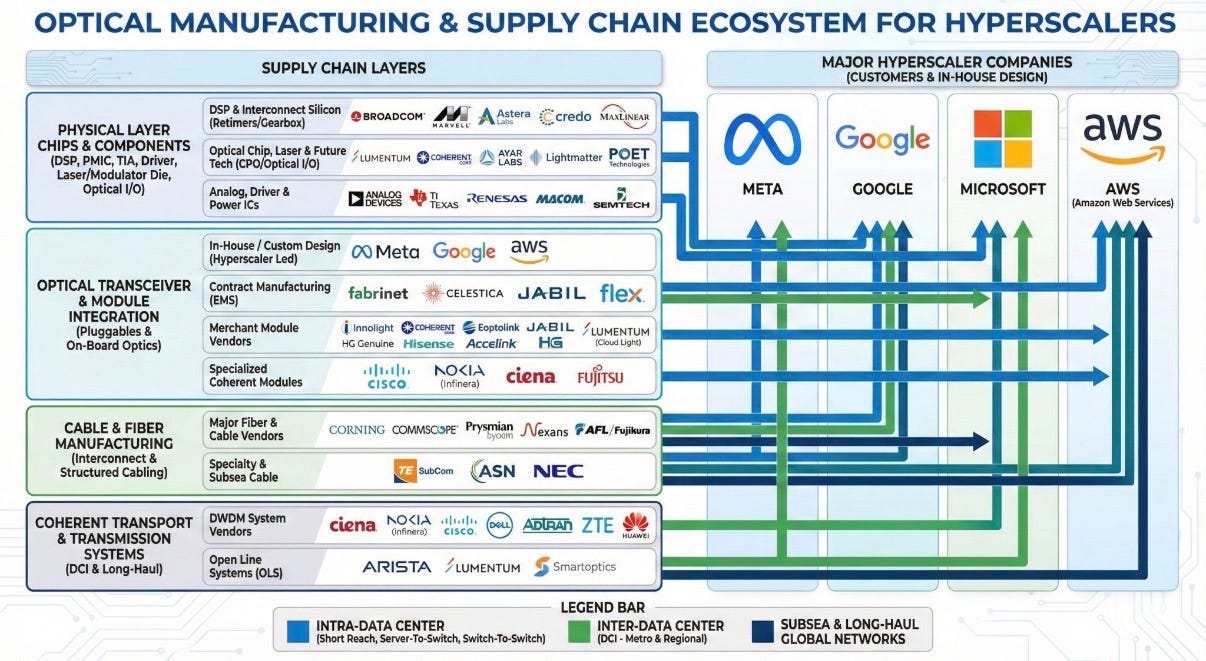

The “Optics” Misconception and the Real AI Data Center Alpha: Superconductivity & Power Density

While the narrative surrounding AI Data Centers often gravitates toward optical interconnects and photonics—the “nervous system” of the cluster—a rigorous forensic analysis of Nexans’ portfolio reveals a counter-intuitive reality: the company has strategically exited the commodity optics market to corner a far more critical bottleneck—the “cardiovascular system” of AI power delivery.

Source: Fabian's Substack, Optics is the next memory

It is imperative to clarify that Nexans finalized the divestment of its Telecom Systems business (which included traditional optical fiber infrastructure for buildings and LANs) in October 2023, consistent with its “Electrification Pure Player” roadmap. For the uninitiated, this might appear as a missed opportunity in the face of the AI boom. However, for the astute capital allocator, this was a masterstroke of shedding a deflationary, high-competition asset to focus on a high-barrier monopoly: Power Density.

The true “Upside” for Nexans in the AI Data Center theme is not in carrying the data, but in carrying the massive amperage required to train Large Language Models (LLMs) without melting the grid. As highlighted in recent analyses (see Fabian’s Note), the density requirements of hyperscale data centers are pushing physics to its limit. Here, Nexans holds a technological ace: Superconducting Cables.

Unlike traditional copper or aluminum, Nexans’ superconducting cables utilize high-temperature superconductors (HTS) cooled by liquid nitrogen to transmit electricity with zero resistance. This allows for the transmission of up to 3 Gigawatts (GW) of power—equivalent to the output of three nuclear reactors—at medium voltage levels (20kV), eliminating the need for massive, space-consuming high-voltage substations near urban data centers. For hyperscalers like Microsoft or Google, who are constrained by urban real estate and grid capacity, this technology is the only viable path to scale power delivery in dense zones. This is not a theoretical R&D project; it is a commercial reality (e.g., the SupraMarine project for offshore wind is a derivative of this tech).

Furthermore, while the general telecom business was sold, Nexans retains a highly specialized, high-margin niche in Subsea Data Transmission. Integrated within its PWR-Transmission segment, this involves “wet design” composite cables that combine high-voltage power with fiber-optic elements for interconnectors. As sovereign clouds and AI clusters require inter-regional connectivity (e.g., the Great Sea Interconnector or Celtic Interconnector), these hybrid systems provide the essential backbone.

Conclusion on Optics/AI: Nexans is not a play on the fiber boom (which is commoditized); it is a play on the energy density required to power the AI revolution. The divestment of the Telecom business was not an exit from tech, but a doubling down on the scarcest resource in the AI stack: reliable, high-density power.

Compounding and Value Creation: The E3 Engine

The financial transformation of Nexans is grounded in its proprietary “E3” management model: Economy, Environment, and Engagement. This is not soft corporate marketing; it is a hard, mathematical algorithm for capital allocation that has fundamentally altered the company’s return profile.

The Mechanism of E3

The E3 model forces a rigorous analysis of the client and product portfolio through three lenses:

Economy: Assessing the Return on Capital Employed (ROCE) of every client and SKU.

Environment: Evaluating the carbon intensity and environmental return.

Engagement: Measuring employee engagement as a leading indicator of performance.

This filtering process has led to a dramatic rationalization of the business. Nexans cut its customer base from over 17,000 to fewer than 4,000 strategic partners and reduced SKUs by nearly 30-40%.22 The logic is counter-intuitive to traditional volume-obsessed industrial management: by shrinking revenue exposure to low-value clients, the company liberated working capital and production capacity for high-margin, strategic partners.

This strategy decouples revenue growth from profit growth and is VERY important when we calculate the stock price later. This fact given, it’s very hard for outsiders just using screener tools, to recognize advancements in operational excellence. While revenues may fluctuate with metal prices or scope changes, the profitability per unit of capital employed has soared. The “return on carbon employed” metric ensures that the company does not chase dirty revenue that might become a liability in a carbon-taxed future.

Quantitative Evidence of Value Creation

The financial statements for H1 2025 and FY 2024 provide irrefutable quantitative evidence of this compounding capability:

EBITDA Expansion: Adjusted EBITDA grew from €665 million in 2023 to €804 million in 2024, a robust +21% year-on-year increase. This momentum continued into H1 2025, with Adjusted EBITDA reaching €441 million, up +7.0% from the prior period.1

Margin Expansion: The Adjusted EBITDA margin expanded from 10.2% in 2023 to 11.7% in H1 2025.1 This steady march upward confirms the pricing power and operational efficiency gains derived from the E3 model.

ROCE Accretion: Return on Capital Employed hit 21.6% in H1 2025, up from 19.7% in H1 2024.1 For the Electrification segment specifically, ROCE is an outstanding 27.5%, evidence of a superior returns profile in the core business.23

Free Cash Flow Generation

A true compounder must generate cash to fund its own growth. Nexans reported a Normalized Free Cash Flow of €454 million in 2024.7 In H1 2025, Free Cash Flow reached €282 million, a massive jump from €79 million in the prior period.1 This improvement was driven by strict working capital management (operating working capital at just 0.5% of sales) and significant downpayments from large transmission projects. This robust cash generation funds the dividend (increased by 13% to €2.60) and the strategic CAPEX required for future growth, all while maintaining a healthy balance sheet.

ROIC vs. WACC: The Value Spread

To assess true shareholder value creation, one must measure the spread between the Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC). A company creates value only when ROIC exceeds WACC.

WACC Estimation (2025)

Estimating the WACC for Nexans involves several components:

Risk-Free Rate: Based on 10-year government bond yields (a blend of French OATs and German Bunds), we approximate this at 3.0% - 3.5% in the current rate environment.

Beta: Nexans’ beta fluctuates but is estimated around 0.87 - 1.05. This reflects its industrial nature, partially mitigated by the stability of utility-scale demand and long-term contracts.24

Equity Risk Premium (ERP): We utilize a standard ERP of approximately 5.75% - 6.0%.26

Cost of Debt: Nexans holds a Standard & Poor’s BB+ rating with a stable outlook. Its recent bond issues suggest a pre-tax cost of debt around 4.0% - 4.5%. After tax (assuming a ~25% effective rate), the cost of debt is approximately 3.0% - 3.5%.27

Using these inputs, analyst estimates and internal calculations place Nexans’ WACC in the range of 5.8% to 7.2%.24

ROIC / ROCE Reality

Nexans reported following numbers for ROCE:

Group ROCE: 21.6% (H1 2025).1

Electrification ROCE: 27.5%.23

The Spread

The spread between ROIC (21.6%) and WACC (~7%) is a massive ~14.6%. This wide spread is the hallmark of a high-quality compounder. It indicates that for every euro of capital Nexans deploys, it is generating significant Economic Value Added (EVA). This justifies a valuation premium relative to book value and confirms that the management’s strategy of shedding low-return assets (like automotive harnesses) to focus on high-return electrification assets is mathematically sound. The disparity between the Electrification ROCE (27.5%) and the group average further validates the “Pure Player” strategy.

Cycle Analysis: Mid-Cycle Expansion with Secular Tailwinds

Understanding where Nexans sits in the business cycle is critical for timing capital allocation.

Sector Cycle: Early-to-Mid Expansion

The electrical infrastructure sector is in the early-to-mid expansion phase of a supercycle.

Demand Side: We are arguably in the second inning of the offshore wind buildout and the first inning of the AI-driven data center power upgrade cycle. The targets set for 2030 and 2050 (Net Zero) imply sustained demand growth for at least another decade.16 The urgency to connect renewables to the grid prevents this from being a standard short-cycle industrial play.

Supply Side: The supply chain is tight. Capacity additions (new factories, vessels) take 3-5 years to come online. We are currently in a “seller’s market” where backlog quality is high, and margins are protected by inflation-indexed contracts and raw material pass-throughs.

Company Cycle: Maturation and Scaling

Nexans itself is in a maturation phase of its transformation.

2018-2021: Turnaround and stabilization under the “New Nexans” plan.

2021-2024: “Winds of Change” – Pivoting to pure player status and disposing of non-core assets.

2025-2028: “Sparking Electrification” – Expansion and scaling.

The company has graduated from “fixing the house” to “building extensions.” The backlog coverage provides visibility through 2028, insulating the firm from short-term cyclical wobbles in the broader economy.7

Inventory Cycle

In the “Other Activities” (Metallurgy) segment, we observed some inventory correction in Q3 2025. This was due to customers overstocking in H1 2025 in anticipation of potential US tariffs.28 This is a classic short-term inventory cycle fluctuation within a broader secular uptrend and should not be confused with a structural downturn in demand.

Catalyst Watch: Triggers for Price Action

Several specific events and situations serve as potential catalysts for the stock price in the near-to-medium term.

1. Great Sea Interconnector (GSI) Resolution (High Impact)

The GSI project (linking Greece, Cyprus, Israel) is a major component of the backlog, representing a €1.43 billion contract. In December 2025, rumors surfaced regarding tender cancellations and potential delays, causing stock volatility.6 Nexans has issued denials, stating there is “no Plan B” and affirming adherence to contractual obligations.30

Bull Case: A definitive “Notice to Proceed” for the full scope or a restructuring of the project funding by the Cypriot/Greek governments would remove a major overhang.

Bear Case: A formal cancellation or indefinite suspension would hit the stock, likely causing a 5-8% downside reaction as the backlog is adjusted.

2. Sale of Lynxeo Closing (Medium Impact)

The divestment of Lynxeo (industrial harnesses) to Latour Capital for an enterprise value of €525 million was expected to close in Q3 2025.15 Confirmation of the final closing and the receipt of cash proceeds will strengthen the balance sheet, potentially triggering a special dividend, share buyback, or enabling further bolt-on acquisitions.

3. Full Year 2025 Earnings (February 19, 2026)

The market will look for confirmation that Nexans hit the upper end of its upgraded guidance (Adjusted EBITDA €810-860 million).1 More importantly, the 2026 guidance will be the first full-year forecast under the new CEO, Julien Hueber. It will test the credibility of his growth targets and whether the “operational tempo” changes.

4. Integration of Electro Cables (Medium Impact)

The acquisition of Electro Cables in Canada (announced Oct 2025) reinforces the North American footprint in the PWR-Connect segment.28 Successful integration and immediate EPS accretion will validate the company’s “bolt-on” M&A strategy in a key growth market.

5. US Offshore Wind Policy

Any clarity or shifts in US federal policy regarding offshore wind (given the political climate) could impact the utilization of the Charleston plant. While the European pipeline is robust, the US market remains a “wildcard” that could provide either upside surprise or utilization drag.

Operational Excellence: The SHIFT and E3 Machinery

Nexans’ operational success is not accidental; it is engineered via the SHIFT program, a systemic approach to performance improvement.

Rationalization: The SHIFT program systematically identifies “value burners”—products or clients that dilute ROCE. These are either fixed (pricing/cost actions) or exited. This discipline is maintained even as the company returns to growth, ensuring that volume does not come at the expense of value.

Digitization: Nexans is leveraging digital tools to optimize operations. The implementation of “SmartPDF” for accounts payable reduced invoice processing time from 2 days to 2 hours with 92% reliability.31 Modernization of ERP systems (Microsoft Business Central) in logistics units enhances data visibility and inventory management.32

Vertical Integration: Nexans produces its own copper rod, shielding it partially from premiums and ensuring quality control. The “local for local” manufacturing strategy minimizes logistics costs and carbon footprint, aligning with the E3 environment pillar.

Innovation: The “AmpaCity” research center in Lyon and the investment in superconductivity (SupraMarine project) position Nexans at the bleeding edge of cable technology.33 This R&D focus creates differentiation beyond simple copper extrusion, allowing Nexans to offer “systems” rather than just “cables.”

Management: The Guard Change

The Departure of Christopher Guérin:

Christopher Guérin, the architect of the “New Nexans,” resigned in October 2025 after seven years at the helm.5 His tenure was characterized by the bold, counter-intuitive shift from volume to value. His departure was abrupt (”effective immediately”), causing an initial 8.4% drop in the stock.34 While the Board cited a desire for “new momentum,” such transitions always raise questions about internal disagreements or strategic pivots.

The Arrival of Julien Hueber:

The Board appointed Julien Hueber as CEO. Hueber is a Nexans veteran (joined 2002) and was previously Executive Vice President of the PWR Grid & Connect Europe segment.35

Profile: Hueber has a deep operational background in Supply Chain and Purchasing, and extensive experience in the Asia-Pacific region (China, South Korea).36

Significance: This appointment signals continuity rather than revolution. Hueber executed the strategy in Europe; his promotion suggests the Board wants to double down on the current roadmap (”Sparking Electrification”) but perhaps with a stronger focus on execution and supply chain resilience. His background is critical given the coming capacity crunches in the industry.

Vincent Piquet (CFO):

Appointed in November 2025 25, Piquet brings a fresh financial perspective. A new CFO alongside a new CEO often leads to a “kitchen sinking” quarter where they reset baselines. Investors should watch the FY 2025 results for any one-off charges or accounting adjustments intended to clear the deck for the new leadership team.

Three Possible Scenarios (5-Year Plan)

Scenario 1: The “Sparking” Success (Bull Case - 30% Probability)

Narrative: Global grid investments accelerate faster than the IEA base case due to AI/Data Center power needs. US offshore wind rebounds with favorable policy clarity. Nexans successfully executes the GSI project without further delays. The new CEO, Julien Hueber, accelerates M&A accretion seamlessly.

Financials: Adjusted EBITDA exceeds €1.2 billion by 2028 (beating the €1.15bn target). ROCE expands to 25%+. Free Cash Flow conversion remains >50%.

Valuation: The market rewards the growth and reliability with multiple expansion to 9-10x EV/EBITDA. Stock price targets €170+.

Scenario 2: The “Steady Conductor” (Base Case - 50% Probability)

Narrative: Nexans meets its 2028 targets (€1.15bn EBITDA). The GSI project faces delays but is ultimately completed or replaced with other backlog. Organic growth stabilizes at 3-5%. The Electrification Pure Player strategy yields consistent, albeit not explosive, margin gains. The “Pure Player” premium holds but does not expand further.

Financials: EBITDA lands at €1.1-1.15bn. ROCE stabilizes at ~20%. FCF generation remains healthy at ~€350-400m annually.

Valuation: Valuation remains anchored around 7-8x EV/EBITDA. The stock grinds higher via earnings growth and dividends. Price target €145-155.

Scenario 3: The “Short Circuit” (Bear Case - 20% Probability)

Narrative: The GSI project is cancelled, leading to write-downs and a hole in the backlog ($1.4bn impact). Geopolitical tensions (e.g., Turkey/Greece, or US Tariffs) disrupt supply chains and close markets. The new CEO struggles with the transition, leading to operational slippage. Copper shortages constrain production volumes.

Financials: EBITDA stagnates or contracts to €750m. ROCE compresses to <15%.

Valuation: Multiple contraction to 5-6x EV/EBITDA as the “growth” narrative breaks. Stock retests lows of €90-100.

Investment Summary

Nexans is a high-quality industrial asset undergoing a critical evolution. The financial hygiene is impeccable: record margins (11.7%), low leverage (0.85x), and strong cash conversion. The strategic positioning is optimal: sitting at the bottleneck of the global energy transition with a protected market share in high-tech subsea cabling.

The “E3” model provides a verifiable framework for value creation that separates Nexans from generic industrial peers. The shift to a “Pure Player” model has removed the conglomerate discount and focused capital on the highest-return opportunities. Financials are robust, with H1 2025 showing continued growth despite high comparables.

However, the recent CEO transition creates a “show me” story for the next 6-12 months. The market hates uncertainty, and the replacement of a visionary leader (Guérin) with an operator (Hueber) requires proof that the strategic vision remains intact. Additionally, the noise around the Great Sea Interconnector creates headline risk that must be monitored closely.

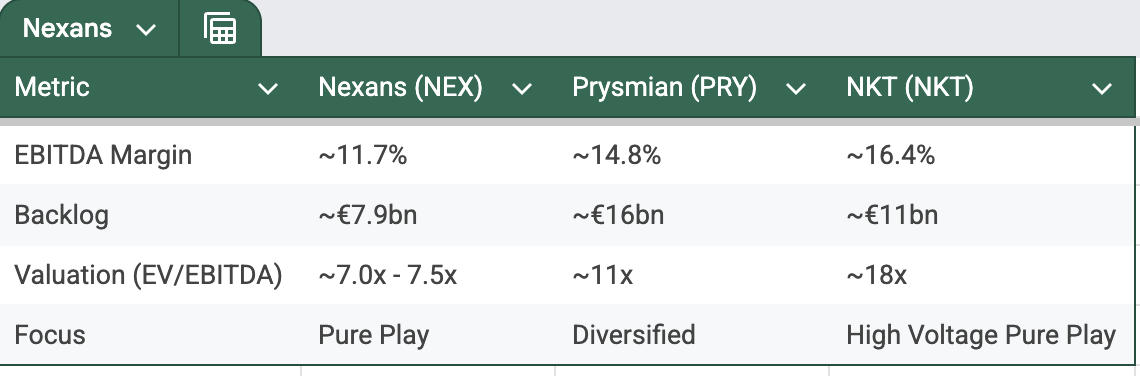

Key comparative data highlights Nexans’ value proposition:

Table Data Sources: 1

Nexans trades at a discount to NKT despite similar exposure to the electrification megatrend, offering a margin of safety.

Final Recommendation

Rating: BUY

Confidence Level: High

Rationale:

Valuation Dislocation: Trading at ~7.0x - 7.5x EV/EBITDA 39, Nexans offers a reasonable entry point for a company with >20% ROCE and secular growth tailwinds. It trades at a significant discount to NKT (~18x) and Prysmian (~11x), providing a valuation cushion.

Structural Growth: The backlog of €7.9bn+ provides immense visibility. The demand for HVDC cables is structural and long-term; short-term project delays do not alter the 10-year demand curve dictated by Net Zero goals.

Balance Sheet Strength: With net debt at €681m (0.85x leverage), Nexans has the firepower to weather storms or make opportunistic bolt-on acquisitions (like Electro Cables) without diluting shareholders.

Dividend: A growing dividend (€2.60, +13%) offers a solid yield to investors waiting for capital appreciation.7

Strategy: Accumulate positions on dips caused by GSI headlines or management transition anxiety. The fundamental engine (E3) is intact, and the destination (electrification) is inevitable.

Important Disclaimer

The content published on this Substack, including all articles, analyses, opinions, predictions, recommendations, and comments, represents solely the personal views and opinions of the author. It is provided for general informational and educational purposes only and does not constitute professional investment advice, financial advice, trading advice, tax advice, legal advice, or any other form of regulated advice. Nothing herein should be construed as a recommendation to buy, sell, hold, or invest in any specific asset, security, cryptocurrency, or financial instrument. The author is not a registered investment advisor, broker-dealer, or financial professional, and no fiduciary relationship is created or implied. Investing in financial markets, including cryptocurrencies and digital assets, involves substantial risk, including the potential for complete loss of principal. Past performance is not indicative of future results. All investments carry risk, and readers should carefully consider their own financial situation, risk tolerance, and objectives before making any investment decisions. Readers are strongly encouraged to conduct their own independent research (DYOR – Do Your Own Research) and consult with qualified professional advisors before acting on any information provided here. The author and this publication assume no responsibility or liability whatsoever for any errors, omissions, or inaccuracies in the content, or for any actions taken in reliance thereon, including any direct, indirect, incidental, or consequential losses or damages. By reading this Substack, you agree to bear full responsibility for your own investment decisions and outcomes.

Nexans_H1-2025-earnings-Press-release-1.pdf

What is Sales and Marketing Strategy of Nexans Company https://matrixbcg.com/blogs/marketing-strategy/nexans

2025-10-23-pr-nexans-q3-2025.pdf

IEA Report: 2025 Energy Investments Set to Hit $3.3tn https://energydigital.com/articles/iea-report-2025-clean-energy-investment-to-reach-us-2-2tn

New CEO to take the lead at Nexans - Offshore-Energy.biz https://www.offshore-energy.biz/new-ceo-to-take-the-lead-at-nexans/

Nexans cancels tenders on frozen Cyprus-Greece interconnector project https://www.4coffshore.com/news/nexans-cancels-tenders-on-frozen-cyprus-greece-interconnector-project-nid32247.html

nexans-full-year-2024-earnings-press-release.pdf

Nexans wins record-breaking contract for the Great Sea Interconnector https://www.nexans.com/press-releases/nexans-wins-record-breaking-contract-for-the-euroasia-interconnector/

Celtic Interconnector | Projects | EirGrid https://www.eirgrid.ie/celticinterconnector

New Leadership at Nexans: Appointment of Julien Hueber as CEO https://www.nexans.co/en/newsroom/news/details/2025/10/appointmentofnewCEOJulienHueber.html

Repair demand in the subsea cable sector: eight key takeaways https://www.spinergie.com/blog/repair-demand-in-the-subsea-cable-sector-eight-key-takeaways

Group Presentation - Nexans https://www.nexans.com/app/uploads/2025/07/nexans-group-presentation-2025.pdf

Top Marine Cables Market Companies - Rankings, Profiles, SWOT ... https://www.reportprime.com/marine-cables-r2587/company

High Voltage Cables Market Share & Trends [2034] https://www.industryresearch.biz/market-reports/high-voltage-cables-market-109598

nexans-q1-2025-press-release.pdf

Global Energy Review 2025 https://iea.blob.core.windows.net/assets/5b169aa1-bc88-4c96-b828-aaa50406ba80/GlobalEnergyReview2025.pdf

Building the Future Transmission Grid https://iea.blob.core.windows.net/assets/744ff0bb-905a-4f9f-83e3-2d04ce99e09c/BuildingtheFutureTransmissionGrid.pdf

Global Energy Investment Hits Record High: Key Takeaways from ... https://www.renewableinstitute.org/global-energy-investment-hits-record-high-key-takeaways-from-the-ieas-2025-report/

Key developments in the global subsea cable sector in 2025 https://www.crugroup.com/en/communities/thought-leadership/2025/key-developments-in-the-global-subsea-cable-sector-in-2025/

Offshore power cable demand is rising rapidly, but is the market ... https://www.spinergie.com/blog/offshore-power-cable-demand

New York copper price surges again, Shanghai sets record https://www.mining.com/new-york-copper-price-surges-again-shanghai-sets-record/

New HEC Paris Case Study on Nexans: Orchestrating Sustainable ... https://www.hec.edu/en/society-organizations-institute/news/new-hec-paris-case-study-nexans-orchestrating-sustainable-business-transformation

2025 HALF-YEAR FINANCIAL REPORT 0 - NEXANS https://www.nexans.com/app/uploads/2025/07/Nexans_H1-2025-Financial-report_EN-v1.pdf

Nexans SA (NEX) Discount Rate - WACC & Cost of Equity https://www.alphaspread.com/security/par/nex/discount-rate

Nexans (EPA:NEX) Stock Price & Overview https://stockanalysis.com/quote/epa/NEX/

Equity Market Risk Premium - KPMG International https://assets.kpmg.com/content/dam/kpmg/is/pdf/2025/10/MRP-Iceland-H2-2025.pdf

NXPRF (Nexans) WACC % - GuruFocus https://www.gurufocus.com/term/wacc/NXPRF

Powering the future with growth and strategic leadership transition https://www.nexans.com/app/uploads/2025/10/2025-10-23-presentation-9m-2025-nexans-financial-information.pdf

Nexans cancels tenders for Great Sea Interconnector project, shares sink https://www.investing.com/news/stock-market-news/nexans-cancels-tenders-for-great-sea-interconnector-project-shares-sink-93CH-4398569

Great Sea Interconnector project update - Nexans https://www.nexans.com/regulated-informations/press-release/

Nexans Case Study | A Partnership Built on Trust and Excellence https://www.basware.com/en/why-basware/customers/nexans

Case Study on Nexans Logistics Ltd - Mercurius IT https://www.mercuriusit.com/project/case-study-on-nexans-logistics-ltd/

Celtic: world longest interconnector cable - Nexans https://www.nexans.com/success-stories/activities/success-stories/celtic-interconnector-project/

Nexans stock falls after sudden CEO change - Investing.com https://www.investing.com/news/stock-market-news/nexans-stock-falls-after-sudden-ceo-change-4283232

Nexans new leadership: appointment of Julien Hueber https://www.nexans.com/regulated-informations/nexans-new-leadership-appointment-of-julien-hueber/

Julien Hueber - CEO at Nexans - The Org https://theorg.com/org/nexans/org-chart/julien-hueber

q3 & 9m25 integrated results - prysmian upgrades 2025 guidance https://www.prysmian.com/sites/www.prysmian.com/files/media/documents/PR_PRYSMIAN_RESULTS_Q3_25_ENGLISH.pdf

Interim report Q1-Q3 2025 - Investor Relations - NKT https://investors.nkt.com/files/Main/23044/4268902/nkt-interim-report-q3-2025_final.pdf

Nexans SA (ENXTPA:NEX) EV / EBITDA - Investing.com https://www.investing.com/pro/ENXTPA:NEX/explorer/ev_to_ebitda_ltm

Post 2Q24 Cables update: Nexans down to Neutral, reiterate Buy on .. https://www.ot.gr/wp-content/uploads/2024/08/%CE%94%CE%B5%CE%AF%CF%84%CE%B5-%CE%B1%CE%BD%CE%B1%CE%BB%CF%85%CF%84%CE%B9%CE%BA%CE%AC-%CF%84%CE%B7%CE%BD-%CE%AD%CE%BA%CE%B8%CE%B5%CF%83%CE%B7.pdf

2024 Capital Markets Day Nexans unveils 2028 ambition https://echanges.dila.gouv.fr/OPENDATA/AMF/MKW/2024/11/FCMKW112883_20241113.pdf

Nexans - Q1 2025, promising start to the year - Euronext Markets https://live.euronext.com/en/products/equities/company-news/2025-04-30-nexans-q1-2025-promising-start-year