Vitec Software: Is Claude Code the VMS Killer?

The Software Black Swan: Can the Bison Mindset Safe Vitec?

0. Preface

This should be a paid article. It’s not. It’s 🆓 The content and information you get here is few and far between. Most of the SaaSmageddon arguments I read everywhere are maybe not totally wrong, but they miss the main point. You can copy anything here, but quote it! And leave a like at the end. Tank you❤️

For those unfamiliar with Vitec or the VMS business, we will provide a general overview in chapters 1 and 2, including information about the current trend of decreasing value - or let’s better say the price on the stock market. Just because we all know: Price is what you pay, but value is what you get.

The article’s main point is that Vitec’s software portfolio is valuable, and it tries to assess the risk of “Death to Anthropic Claude Code.” You can skip the introduction and go to the exciting part in chapter 3 if you are already familiar with Vitec or VMS in general. In chapter 4, we will talk about the impact of Claude Code and the End of the “System of Record” Theory on Vitec’s portfolio and how Vitec can become even stronger stronger - the last financial report was way better that expected.

1. The SaaS and VMS Universe - Past and Present

We are at a turning point in the history of software investing. The release of Anthropic’s Claude Code and its associated “Cowork” plugins in February 2026 has triggered a market wide shockwave of the durability of software moats — mostly called the “SaaSmageddon” or “SaaSocalypse.” Investors are fleeing the horizontal SaaS sector, fearing that autonomous AI agents will commoditize code and automate tasks.

On February, 05 2026 the situation (the fire sales) of SaaS Enterprise Software and even VMS got that dramatic, that the management of Chapters Group, $CHG.DE, a noteworthy German VMS specialist, with private investments from the Danaher management, felt force to release an open letter to its stakeholders and shareholders:

Hello!

As most other software stocks, CHAPTERS has seen a decline in share price recently.

I'm writing you as I have received a lot of outreach from investors in last 24 hours. Investors called to ask "what's wrong?", "are you ok?" and "how's AI hurting you?". Everyone has been incredibly kind and many have been worried. About the business and about us as a team.

First and foremost, everyone is in great spirits and well.

In that context, I decided to proactively reach out to put a few aspects into context.

Importantly, we are currently in Closed Period and hence I cannot comment on current trading or financial outlook. We will update on this in March.

However, I can comment on AI and how it affects our business. Remember, CHAPTERS predominantly runs software companies that provide essential systems of records. Oftentimes to the public sector. We call our services "mission critical", because they are to our society.

For instance, we recently added a business called Icomedias to the group. Icomedias runs "Onlinewache", the citizen-to-police communication interface in Germany. It connects 84m Germans to all local police authorities and ensures safe, reliable and efficient administration of e.g. criminal complaints. The pure cost of building such software was never the constraint. The constraint has always been in distribution of software, creation of a unified standard across hundreds of police authorities and provisioning a secure solution.

The idea of someone vibe coding a replacement in Claude that will find quick adoption is almost comically absurd in the case of VMS products like Onlinewache. Who's maintaining that code? Who has an incentive of training everyone on a new system? Who ensures the right cyber security standard?

Clients never bought software. Clients bought solutions. And a true solution needs way more than cheaply built code.

Does that mean I'm relaxed about the impact of AI? Not at all.

In fact, AI provides an astonishing opportunity to layer applications on top of the systems of record we provide. Our destiny is to enable clients to use more software. Or, more likely, use our software to derive more insights on their operations by finally creating a data-to-insight loop. Everybody has talked about this for the last 20 years. AI may finally make this realistic. And it's on CHAPTERS to unlock that potential for our clients.

What keeps me up at night is not AI disrupting CHAPTERS. What keeps me up at night is that we are not aggressively enough pursuing the opportunity AI gave us.

Never before in CHAPTERS' history did we have more liquidity fire power to deploy capital into M&A. Our recent bond placement proved wise. Cash generation has been strong. Leverage at OpCo & Platform level is far from maxed out. To that end, we are actively looking for opportunities to deploy capital into VMS M&A. If you hear of a strong VMS business where shareholders want out because they fear AI - please give me a call. We would love to explore providing these investors with liquidity. And use AI to improve that business for the next decades to come.

As always, do not hesitate to reach out to me, Andreas, Marlene or Marc and discuss any of this.

All the best

Jan

In this turbulent environment, Vitec Software Group (VIT-B), headquartered in Umeå, Sweden, presents a paradox. Is it a legacy relic waiting to be disrupted, or is it the ultimate defensive bunker against the AI storm?

As I sat here writing this article I wore the Rich Froning Bison T-Shirt. Rich Froning was the first “Fittest Man in History” (Prime Video) and now runs a bison farm in the nowhere of Tennessee.

The Bison Metaphor: Face the Storm

The analogy of the bison is a powerful symbol of resilience and proactive problem-solving, based on how animals react to storms on the American Great Plains.

The Cow Strategy: When a storm approaches, cows try to run away from it. Because the storm moves faster than they do, they end up staying in the rain and wind much longer, essentially traveling with the storm.

The Bison Strategy: Bisons instinctively turn and charge directly into the storm. By running toward the wind, they pass through the weather front quickly, minimizing their exposure to the cold and rain.

Core Lessons

Confront Problems Directly: Avoiding a challenge only stretches the struggle. Facing it head-on is the fastest way through.

Short-term Intensity, Long-term Relief: The “bison way” is harder in the moment, but it leads to sunlight much faster.

Build Resilience: Approaching fears directly builds inner strength and reduces the time spent in a “victim” mindset.

Source: Own Creation

Vitec is not just a regular software company, it’s a capital allocation engine operating within the protected boundaries of Vertical Market Software (VMS). For forty years, Vitec has executed the more or less same strategy: acquiring small, mature software companies that serve specific, regulation heavy industry niches—from pharmacy management in Denmark to electricity grid balancing in the Netherlands. These are not “nice-to-have” productivity tools; they are the “Systems of Record” upon which society functions. Keep the “System of Record” phrase in mind, it will be very important later.

The investment theory for Vitec is based basically on three pillars that differentiate it from the broader tech sector:

The Compounder Dynamic: Unlike venture backed SaaS companies that burn cash to grow, Vitec utilizes a high proportion of recurring revenues — 88% of sales in 2025 — to generate immense operating cash flow (SEK 1.1 billion). This cash is then reinvested into acquiring even more cash generating assets. This self-funding flywheel effect minimizes the need for dilutive equity raises. However, management is pragmatic about using equity when strategic opportunities arise, as demonstrated by the 2024 directed share issue.

Why Boring is Beautiful: Vitec operates in markets with naturally capped Total Addressable Markets (TAMs). This sounds like a weakness but is its greatest strength. Global tech giants and AI disruptors ignore these “micro verticals” because they lack the scale to move the needle for a trillion dollar company. Who else wants to build “administration software for religious organizations in Finland” (Vitec Katrina) or “software for the global lubricant industry” (Olyslager)?

Complexity: Vitec buys companies at private market multiples (typically lower) and trades at a public market premium (typically higher, P/E ~35-40x). This gap creates shareholder value, provided the acquired companies continue to compound. The complexity of the regulatory environments Vitec operates in—such as EU energy grid compliance or healthcare data privacy—creates a barrier to entry that generic AI agents cannot easily breach without significant liability risks.

In the past Vitec, was a steady compounder, not a growth rocket. Its organic growth typically is in the mid-to-high single digits (5-9%), supplemented by acquisitions. The compounding works long term, not a sudden explosion in user adoption or bigger price increases.

2. The VMS’s Bull Thesis Arguments In Short

Vitec got a “Moat of Fragmentation.” Unlike a singular wide moat based on a patent or network effect, Vitec’s defensibility is constructed from hundreds of smaller, localized moats surrounding its 47 business units.

2.1 High Switching Costs (The “Pain” Moat)

The software Vitec provides is deeply embedded in the daily operations of its customers. Consider Vitec Aloc, which provides investment management solutions for banks and pension funds in Scandinavia. Replacing such a system is not just an IT project; it is an operational heart transplant. It involves migrating decades of financial data, retraining staff, and risking regulatory non-compliance during the transition. Consequently, Vitec enjoys extremely low churn. But let’s be crystal clear here. Just because it’s hard to do, some companies may be customer forced to migrate anyway. The german DKB broker was one of Germany’s first online only broker. Today, is’s considered legacy. They’re now forced to migrate their entire brokerage core system to a more agile fintech startup. The user wants neo broker UX, also in traditional institutions.

While specific churn numbers are rarely disclosed for competitive reasons, the consistent growth in recurring revenues (up 11% in 2025) suggests customer retention is near absolute. The software typically represents a fraction of the customer’s total cost base (often <1%) but governs 100% of a critical revenue generating or compliance process. This asymmetry grants Vitec significant pricing power, allowing it to raise prices in line with or above inflation (CPI+) without losing customers. At least until now.

2.2 Regulatory and Cultural Capture (The Local Moat)

Vitec’s moat is reinforced by the localization of its products.

Regulatory: Vitec Cito manages pharmacy prescriptions in Denmark. This requires direct integration with the Danish Health Authority’s networks and strict adherence to national pharmaceutical laws. A generic AI agent from Silicon Valley cannot legally replicate this workflow without undergoing years of certification.

Cultural: Vitec Samfundssystem and Vitec Katrina serve the administration of churches in Sweden and Finland. These systems handle member registries, booking of ceremonies, and cemetery management. These workflows are idiosyncratic, steeped in local tradition and church law. They are “too small to care” for global players but essential for the users.

Infrastructure: Vitec Enova and the newly acquired NMG (Poland) and Trinergy (Belgium) operate in the energy sector. As Europe transitions to renewable energy, the grid requires complex balancing software to manage volatility. These systems must integrate with national grid operators (TSOs). The barrier to entry here is not just code; it is the trust and certification required to interact with critical national infrastructure.

2.3 Portfolio Fit

Vitec fits perfectly into a Long-Only Quality/Compounder Portfolio. It serves as a stabilizer—a “sleep well at night” asset that provides exposure to the digitalization of the European economy without the binary technology risk associated with single product companies. It acts alsmost as a “European Tech Small Cap ETF”. It also acts as an inflation hedge (via pricing power) and a defensive play against economic cycles (due to the mission critical nature of its products). For a GARP (Growth At A Reasonable Price) investor, the current valuation in the software sector offers an attractive entry point relative to historical multiples.

Now we’ve heared the standard arguments, let’s get to the article’s core thesis and hopefully a new train of thought.

3. The Software Black Swan

Most people are not even close to understand what’s really happening right now. We are NOT talking about Claude Code, who can automatically rewrite all of the existing software products and offer them for almost free to anyone wo is willing to implement it, including code due diligence, etc. etc. The arguments from chapter 2 would protect VMS software companies from this threat largely.

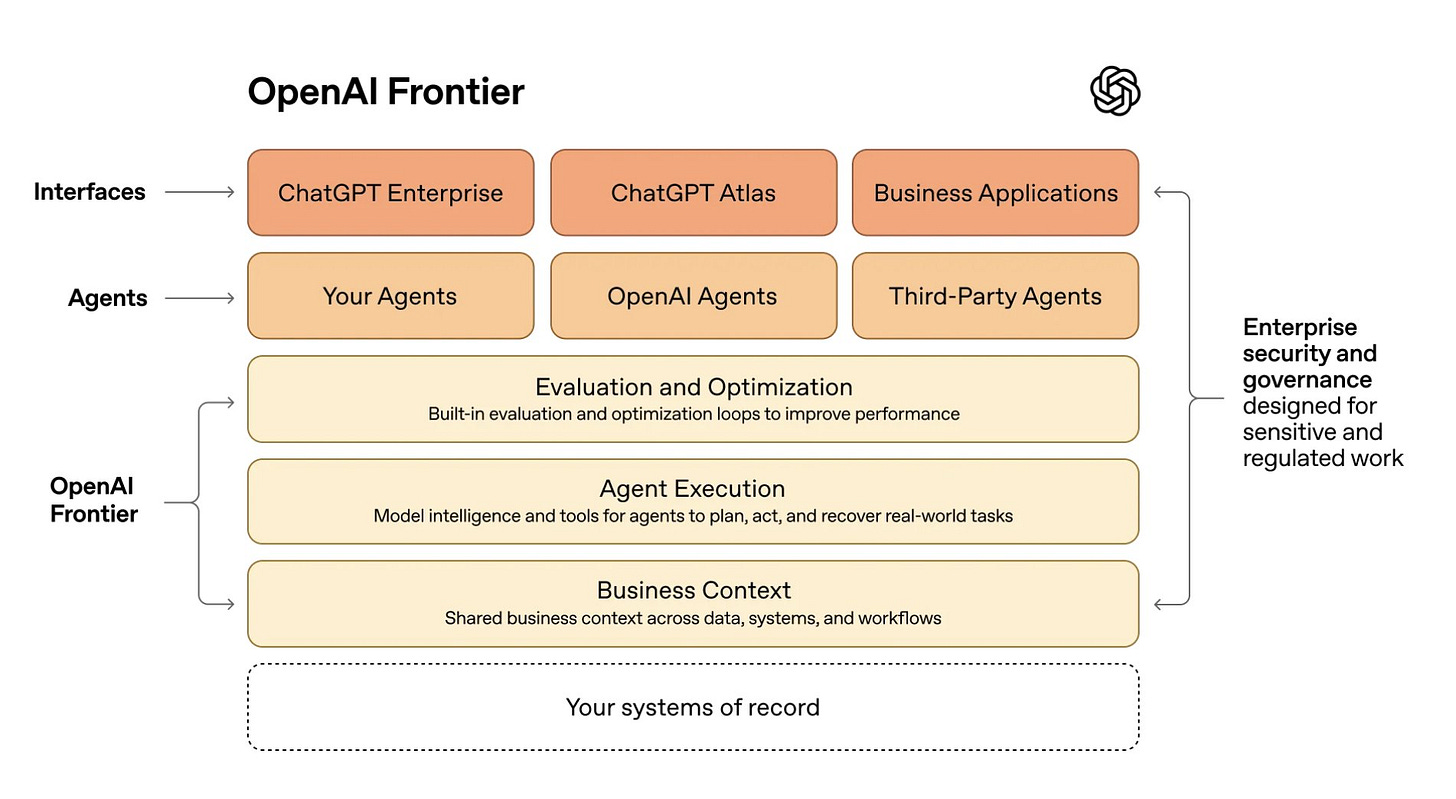

Source: OpenAI

In this context OpenAI Frontier is very similar to Claude Code’s concepts. Now scroll back to the point, where I said, “System of Record” will be very important. Check out where “Systems of Record” sits in this diagram from OpenAI Frontier. At least 3, if not 4, layers of context and intelligence sit between them and the end business application. It’s one of the obviously representations of how AI companies plan to build next gen “Systems of Action” on top of existing “Systems of Records” and why the markets are so worried about the future of software companies. A “System of Action” is an AI enabled, proactive software layer that sits on top of traditional, passive "Systems of Record" (like CRMs or ERPs) to automate workflows, analyze real-time data and execute tasks autonomously.” Even the color coding subliminally shows where OpenAI thinks value will increase. The “System of Records” layer is white and can be hard to see if you don’t look closely! That is the thread we are talking about. SaaS isn’t going away anytime soon, but the value creation will move to the upper layers.

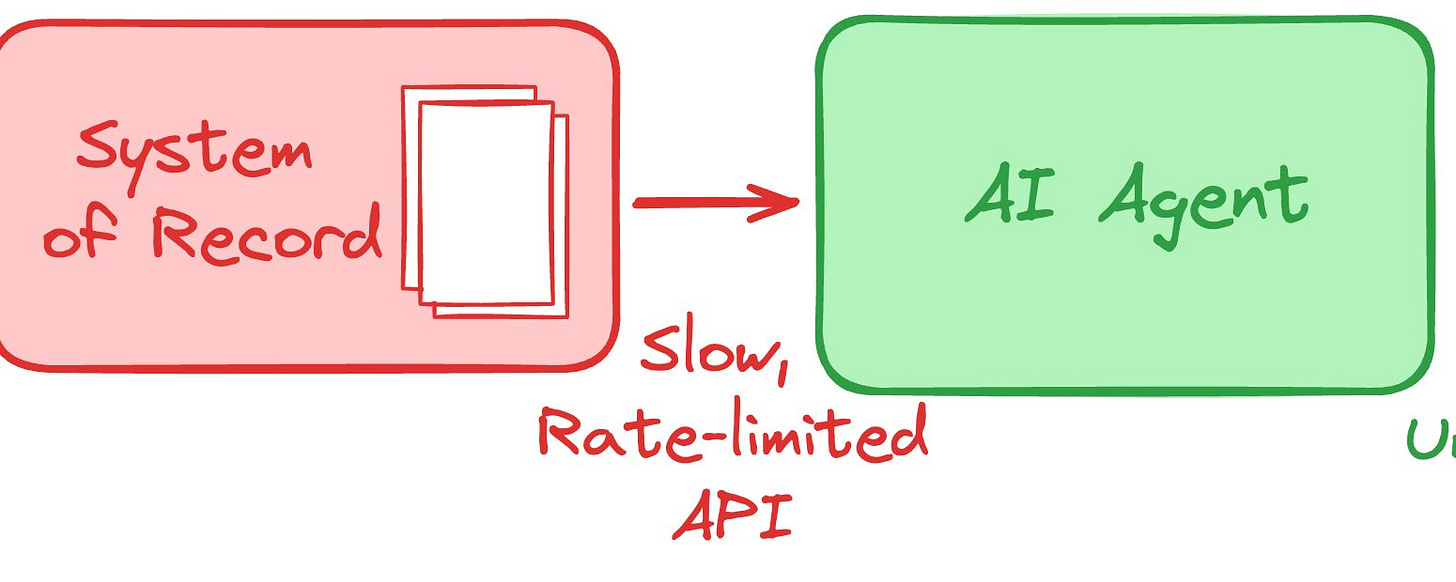

Now we got the context, let’s think outside the box and paint future scenarios. The described threat is just the beginning, a darker scenario could look like the following. Right now, it works basically like that:

Source: Zain Hoda

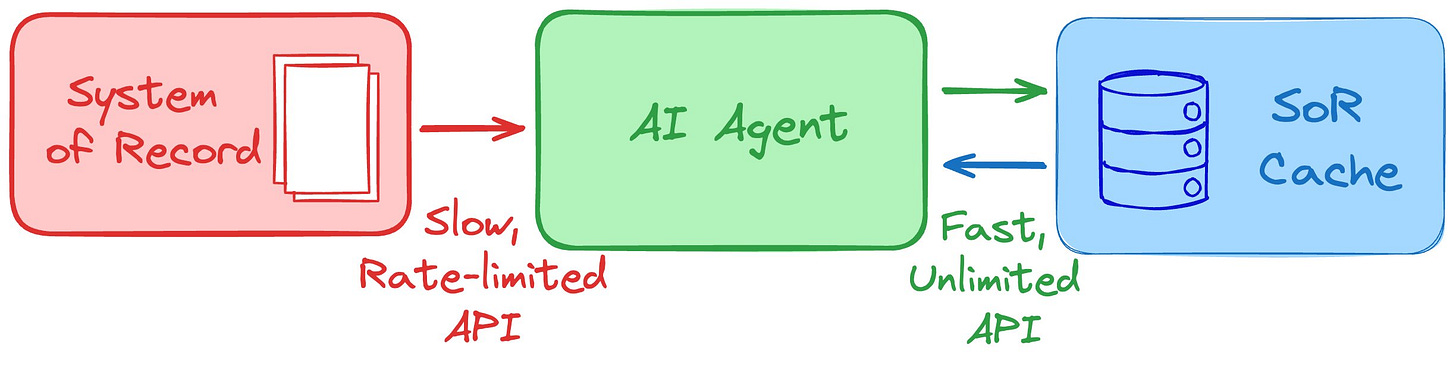

But nothing stops us to go to an additional layer:

Source: Zain Hoda

Don’t wonder, if OpenAI, Claude, etc. build a caching layer on top of the “System of Record” that can migrate off it instantly, especially if the agent will become the primary interface.

🚨 THIS IS WHAT WE ARE TALKING ABOUT:

We are shifting from an era of raw data storage to an era of agency. Traditionally, software giants like Salesforce or HubSpot and many more held power because they were the “System of Record”—the physical place where your data lived. However, AI agents now act as a primary interface that clones, caches, and synchronizes this data almost instantly. Because the agent becomes the place where you actually work and ask questions, the original software is relegated to a “write endpoint” or a background database.

Data itself is no longer the primary value or “moat” because it is now liquid. When an agent can bypass rate limits and replicate a database in seconds, “owning” the data provides no competitive advantage. If the user never looks at your UI and the agent doesn’t need your platform to process the information, the storage provider becomes irrelevant.

To survive, companies must move beyond being digital filing cabinets and instead offer complex workflows or network effects that an agent cannot easily replicate‼️

That’s the threat, and the threat is real. Even stuff like rate limits etc. won’t save you. Switch over to Zain Hoda if you want to dig deeper here.

For the last decades, data was the moat. That changed quickly for Enterprise SaaS Software, especially in the public cloud domain. Now we know, the Software Black Swan is not just a threat, it’s real, let’s evaluate Vitec’s portfolio.

4. Vitec Portfolio aka Including Claude Code Effect, Impact on Goodwill and the SoR Argument

Because no one has done it yet (at least to my knowledge), I will break down Vitec’s portfolio and we will explicitly evaluate, how exposed the single software companies or segments of Vitec are affected of the Claude Code AI plugin effect. I did some dissolute deep dive on the verticals and tried to mix the my collected research information with my 20+ year in enterprise software experience to value each vertical. This is the basis for our further valuation process.

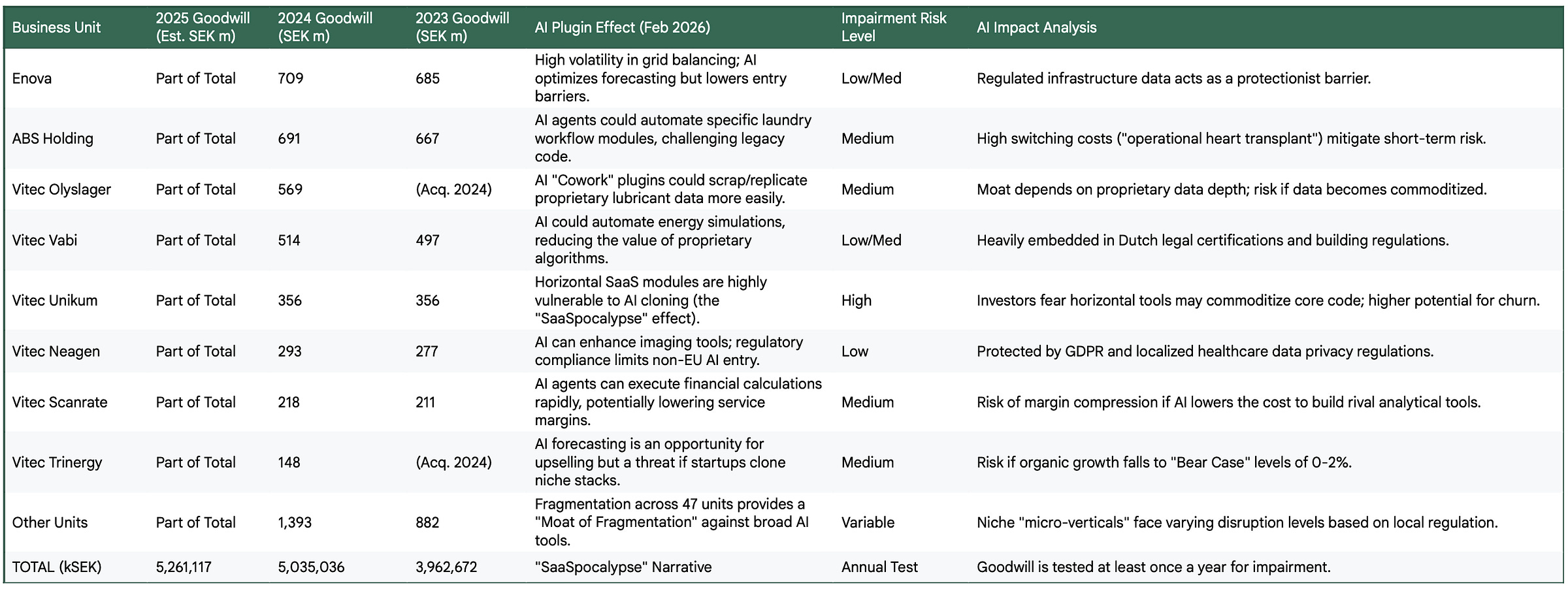

The following table presents the goodwill development for Vitec’s major business units over the last three years, supplemented with an analysis of the potential “Claude Code Effect“ and associated impairment risks based on the February 2026 market projections.

Goodwill Development and AI-Related Financial Risks (SEK million)

Source: Own Creation

Same table as pdf for better reading:

Key Insights on the Claude Code Effect (February 2026)

1. The “Amortization Shift”: As of 2025, Vitec is experiencing an increase in regular amortization (reported under operating expenses) because newer acquisitions have more internally generated intangible assets (capitalized R&D) on their balance sheets. factoring in the Claude Code effect, if Vitec utilizes these AI tools internally to slash R&D costs by 30-50%, the Cash EBIT margins could return to the >30% target despite higher accounting amortization.

2. The “Bear Case” Scenario: A 30% probability is assigned to a “SaaS Stagnation” scenario where AI lowers barriers to entry, enabling competitors to clone Vitec’s niche software at a fraction of the cost. In this case, churn could rise to 10%, and goodwill (currently exceeding SEK 5.2 billion) would face substantial impairment pressure if the “value-in-use” falls below carrying amounts.

3. Defensive Moats: The sources posit that Vitec’s localized, regulation-heavy niche software (e.g., Danish pharmacies or Finnish church administration) is inherently more resistant to generic AI agents than horizontal SaaS like Slack or Salesforce.

4. Operational Deleverage: While the 2025 data shows operating cash flow grew by 17%, the EBITA margin compressed to 26%. factor in the Claude Code plugins, management must successfully deploy AI efficiency to restore margins, or the currently high P/E multiples (~43x) may face a valuation disconnect.

5. The Claude Code Effect: Outside of Vitec’s historical financial data, the “Claude Code Effect” (February 2026) suggests that while AI may increase developer productivity by 30-50%, it also increases the risk of software “cloning” by competitors.

6. Amortization vs. Impairment: Vitec does not amortize goodwill; it instead performs an annual impairment test. If AI tools commoditize Vitec’s software to the point that “value-in-use” drops below carrying amounts, significant write offs may be required.

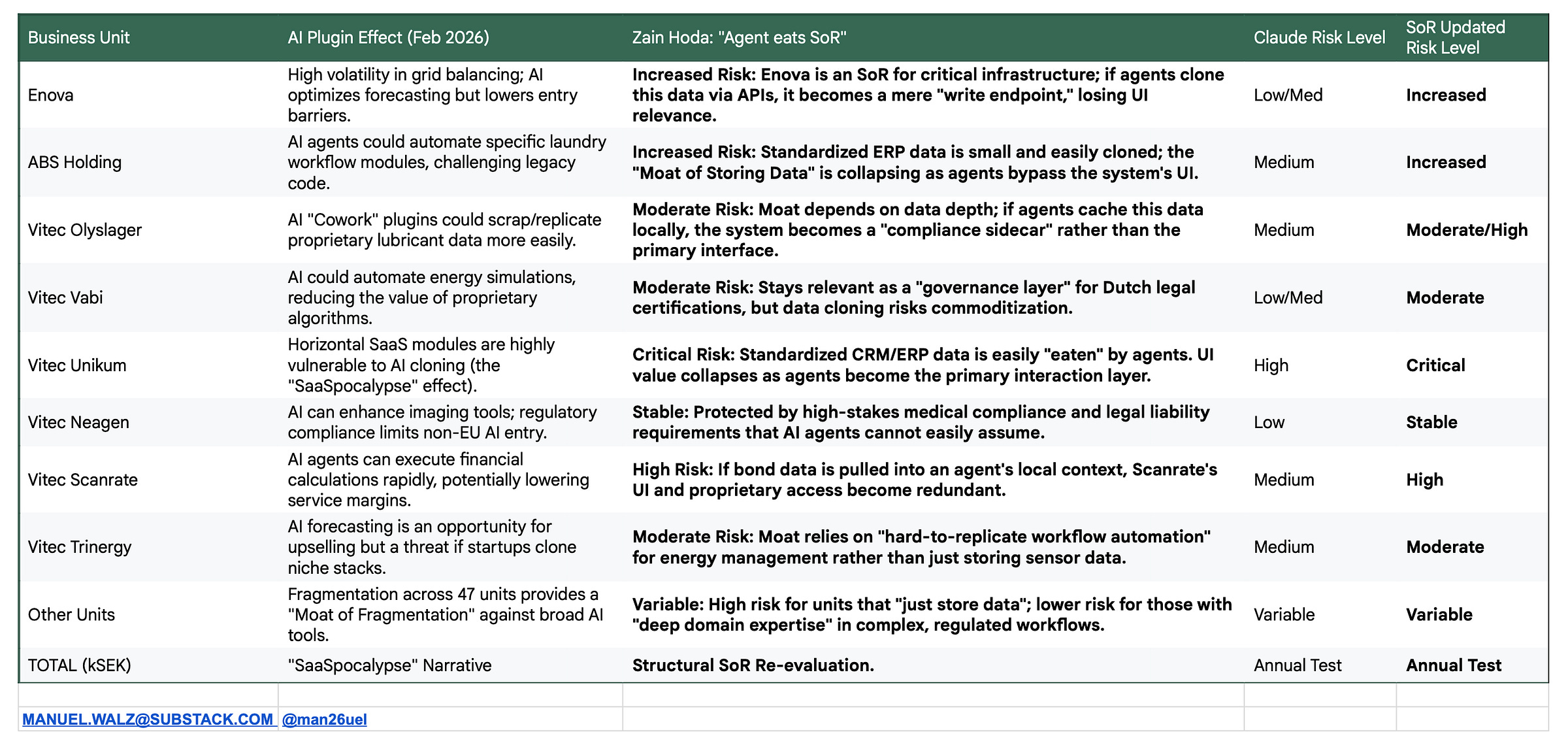

Now we got a good picture on the The Claude Code Effect to Vitec’s portfolio, we need to factor the “System of Records” argument in. And that’s gonna be tricky. Ajust it to your own assessment.

Source: Own Creation

Same table as pdf for better reading:

Key Strategic Re-evaluations, based on Zain Hoda

1. The Collapse of Data Moats: Vitec’s main strength has been its “Systems of Record,” which are the tools that society uses. However, the data within these systems is often “small” (in Gigs) and “trapped” behind user interfaces (UIs). Zain Hoda says that AI agents now go against this idea by using permissive APIs to copy entire databases in minutes.

2. From User Interface to Storage DBs: For Vitec business units like Unikum or Mäklarsystem, the risk is that the agent becomes the main way that customers interact with the company. The software system is now just a “stupid” DB which is where data is created before being “sucked into the agent’s context.” This makes Vitec’s pricing power and UI value weaker.

3. Governance as the Final Fortress: Vitec units in highly regulated areas (for example, Vitec Cito for Danish pharmacies or Neagen for Finnish healthcare) may survive as the “governance layer.” While agents can clone data, they cannot easily replicate the legal responsibility, necessary audits, and compliance rules required in these sectors.

4. Workflow vs. Storage: To avoid future goodwill write offs, Vitec must change from being a place that “stores data” to one that provides “workflow automation that is hard to replicate.” The SEK 5.26 billion goodwill is at risk if units only rely on data storage as their main advantage.

Whatever your own conclusion is, the risk level is definitively elevated. Leave a comment what you think!

3. Sector and Macro Overview

3.1 The Niche: Vertical Market Software (VMS)

VMS is the most resilient sub sector of the software industry. Horizontal SaaS companies (e.g., Salesforce, Slack) are currently fighting a war on two fronts: saturation of user seats and the threat of AI automation reducing the need for human licenses. VMS companies, however, sell outcomes and compliance, not just seats. The VMS market is characterized by:

Fragmented Supply: Europe alone has thousands of small, founder-led software companies serving specific niches. This provides a long runway for Vitec’s acquisition strategy.

Oligopolistic Structures: Most verticals support only 2-3 players. Once established, the incumbent is incredibly difficult to attack.

3.2 Compounding Value in a New Rate Cycle

For the past decade, Vitec was able to raise money on low interest rates to fund their M&A strategy. The shift to a more normalized interest rate environment (3-4%) in 2024-2025 has made the math harder, but did not break the model.

ROIC vs. WACC: Vitec’s Return on Invested Capital (ROIC) on an accounting basis to be approx. 9-11%. However, this metric is influenced by the heavy amortization of intangible assets (customer lists, technology) acquired in M&A deals. Because Vitec buys companies with mature (outdated?) codebases, the maintenance capex is far lower than the accounting amortization.

Cash ROIC (CROIC): We need to adjust for non-cash amortization, the Cash Return on Invested Capital is significantly higher, probably in the 15-20% range. This is very important. Regular stock scanners will give you just the ROIC, whih is correct, but not what we are looking for.

WACC: With a stronger balance sheet following the 2024 equity raise and bond issuance, Vitec’s WACC should be around approx. 7.5-8.0%.

To sum Vitec's value proposition up: a capital allocation engine that appears less profitable on paper due to accounting rules but remains highly cash-generative in practice, CROIC>>WACC.

3.3 The “SaaSpocalypse” and the AI Cycle (February 2026)

The release of Anthropic’s Claude Code in February 2026 has sent shockwaves through the markets. This AI agent can autonomously write code, debug software, and execute complex workflows.

The Threat: Investors fear that AI will allow customers to build their own bespoke tools, bypassing VMS vendors, or that startups will use AI to clone Vitec’s software at a fraction of the cost.

The Counter-Thesis: This view is overly pessimistic for regulated VMS. An AI agent can write code, but it cannot insure liability for a pharmacy dispensing error or certify energy grid compliance. Vitec’s value is shifting from “providing the code” to “providing the trusted, liable, and integrated workflow.” This is in line with chapter 4: Vitec offers in many (probably not all) compelx workflows in regulated areas.

The Opportunity: A new cycle is upcoming where Vitec utilizes these AI tools internally to slash its own R&D costs. Vitec employs over 600 developers. If Claude Code increases developer productivity by 30-50%, Vitec can either accelerate product development or significantly expand gross margins. We can assume that Vitec will transition from a “System of Record” to a “System of Intelligence,” embedding AI agents inside its vertical stacks (e.g., an AI that automatically balances the church budget or predicts energy grid loads). That will be the smart way to use the own, proprietary data and expose them just to the own AI Agents. This will most likely work in regulated areas within sovereign boundaries.

4. The Digital Supply Chain (nothing to worry about here)

Vitec sits in a comfy position in the digital supply chain. It is not a manufacturer of physical goods, but it is the digital asset manager for essential services.

Upstream Dependencies (Who Vitec Needs):

Talent: Vitec relies on a steady stream of developers and domain experts. The decentralized model allows them to hire in secondary cities (Oulu, Zwolle, Umeå), avoiding the wage inflation of tech hubs. The new availability of AI coding agents (Claude Code) actually secures this supply chain by reducing reliance on senior developers.

Infrastructure: Dependency on public cloud providers (Azure, AWS) is high. Fluctuations in cloud compute pricing are a risk factor. With the emergence of sovereign european solutions , e.g. STACKIT, this risk will be manageable longterm.

Acquisition Targets: The “raw material” for growth is private VMS companies. The supply remains robust due to the demographics of aging founders in Europe looking for exit strategies. The lowering multiples for acqusition prices and for SaaS multiples in general will create an additional layer of safety.

Downstream Dependencies (Who Needs Vitec):

Public & Regulated Sectors: A significant portion of Vitec’s revenue comes from sectors that must operate regardless of the economic climate: Healthcare (Vitec Acute, Cito), Energy (Enova, Energy), Public Housing (Vitec Fastighet) and Education (Vitec MV, Intergrip).

Society: There is always a “Societal Criticality” factor. If Vitec’s software fails, pharmacies in Denmark stop dispensing (Vitec Cito), and electricity trading in the Netherlands is disrupted (Vitec Enova). This dependency grants Vitec immense stickiness.

Tariffs and Data Sovereignty:

Vitec is insulated from physical tariffs but operates within Digital Sovereignty. The EU’s GDPR and AI Act act as protection barriers. They make it extremely difficult for US-based AI giants to swoop in and displace Vitec, as they cannot easily meet the local data residency and compliance requirements - US CLOUD ACT. Vitec’s local presence in 13 European countries is a strategic asset here.

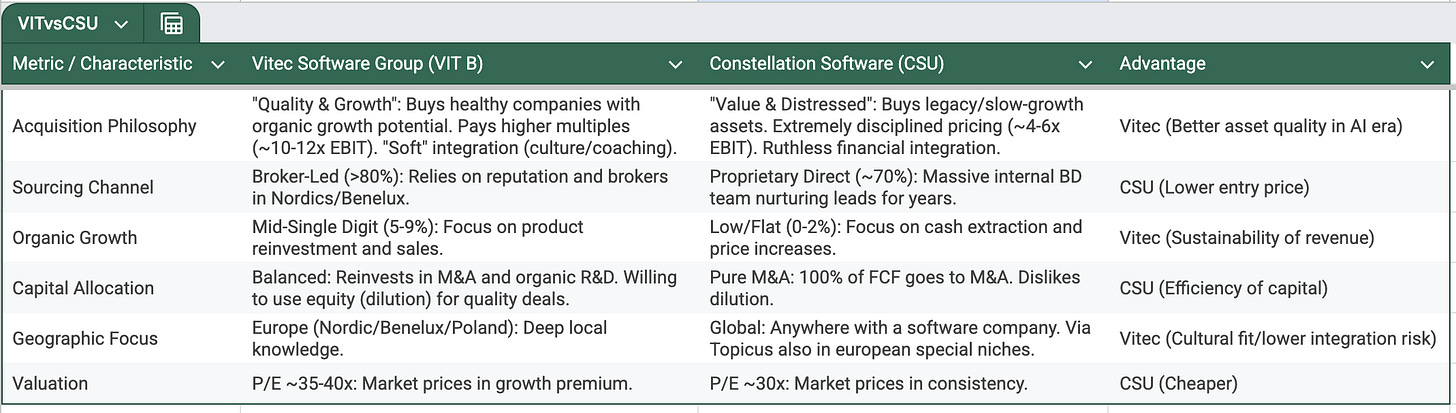

5. Vitec vs. Constellation Software (CSU) - High Noon at 12 o’Clock

Investors often just label Vitec as the “Swedish Constellation.” While they share a genus (VMS Serial Acquirer), they are different creatures.

Source: Own creation

My very own arguments why i’m in favour of Vitec instead of CSU:

In the age of AI, “legacy” on-prem software (CSU’s bread and butter) is the most vulnerable to disruption by agile AI agents. Vitec’s portfolio, a high stake is consisting of modern SaaS platforms with organic growth, is more defensible.

Vitec’s soft approach appeals to European founders who care about their legacy and employees. This gives Vitec something like a preferred buyer status in the Nordics and Netherlands, allowing them to win deals against PE firms even without being the highest bidder. Often, they don’t buy 100% of the company and leaving existing owner a smaller stake to participate on future success; they stay defacto onboard.

Vitec (Market Cap ~SEK 22bn) is way smaller than CSU (~CAD 80bn). It has a much longer runway to compound before hitting the “law of large numbers” that forces CSU to do massive deals or spin off divisions.

I like the financial structure of Vitec with the 2 share types, which secures long term thinking of the owners.

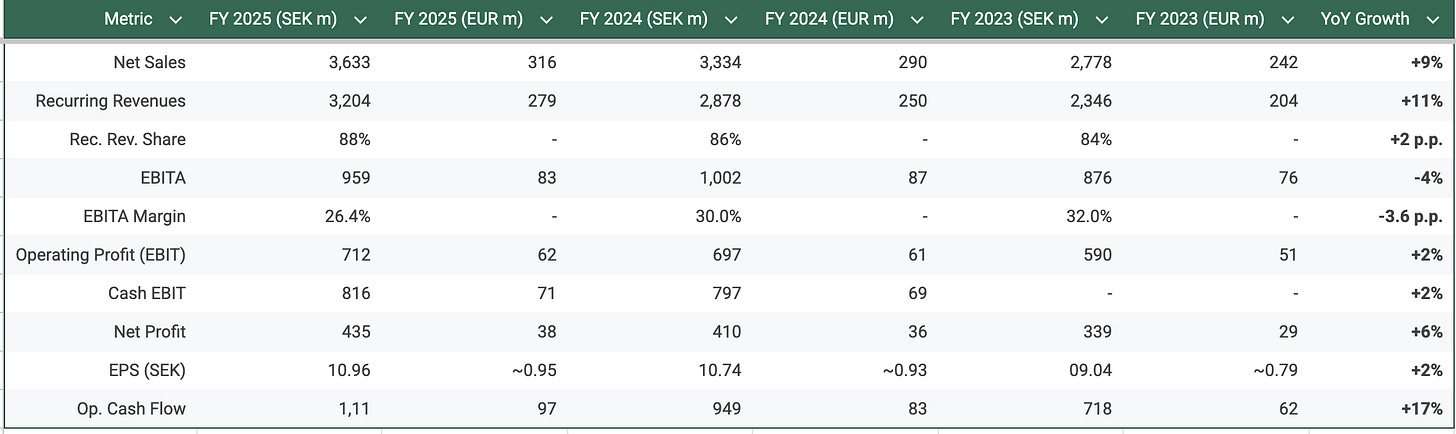

6. Financials: The Numbers Do Not Lie

Note: All currency conversions utilize an approx. rate of 1 EUR = 11.50 SEK. Data from financial reports 2023-2025.

Consolidated Financial Trend Analysis

Source: Extraction of original IR material

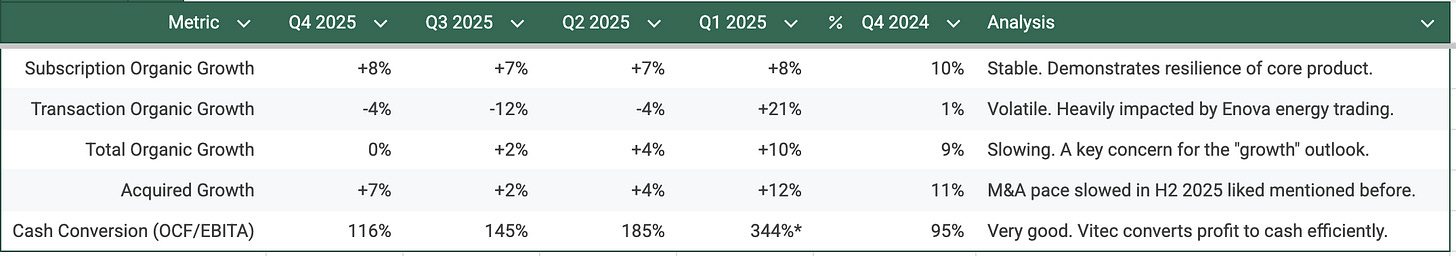

SaaS & Efficiency Metrics (TTM)

Note: Q1 cash flow is seasonally high due to some annual prepayments like highlighted in the IR material.

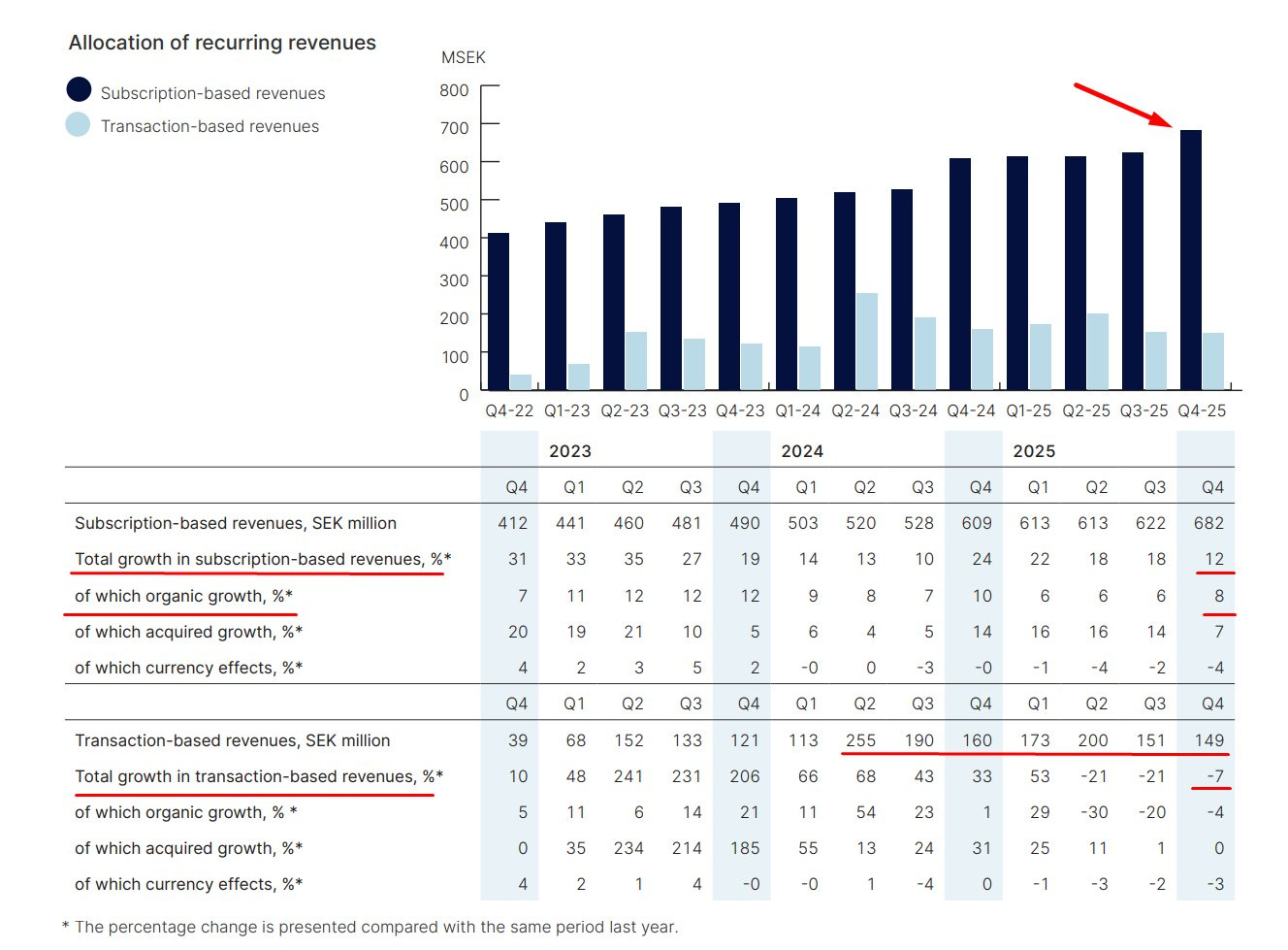

Subscription Organic Growth

Source: Vitec IR, Daniel Pronk

For Vitec, we need to focus on subscription organic growth. Total organic growth includes volatile transaction based growth. Vitec's subscription organic growth actually accelerated the last quarter. The organic growth was also stronger in 2023 due to higher inflation. If you want the absolute best metric, look at subscription based organic growth relative to inflation, which was very strong in Q4/25. The report was better than I thought it would be. I was expecting things to be worse based on what the CEO said last quarter. He made it sound like Vitec would not grow at all in Q3, but the business actually grew a lot. I think they’re going to do really well in 2026.

Net Sales grew by 9%, yet EBITA fell by 4%. Management explains this margin compression to two factors:

Companies that have bought other companies now have more “internally generated assets” (money spent on research and development) on their balance sheets. This leads to higher costs, which lower the bottom line.

The Dutch energy unit (Enova) had an exceptional year in 2023/2024 due to energy market volatility. In 2025, volumes and spreads normalized, acting as a drag on transaction based margins - should be a short therm issue without further need to action.

The amortization explanation should be technically an accounting issue, but the drop in Cash EBIT margins (from 24% to 22%) suggests real operational deleverage. This suggests that recent acquisitions (possibly Enova or others) came with higher initial costs that have not yet been reduced. The company’s operating cash flow increased by 17%, which goes against the idea that the business is struggling; at least to my opinion. The company is making more cash than ever, even if its accounting profits are down. Cash is king, and Vitec is printing it right now.

7. Catalyst Watch

We need to monitoring specific triggers that could re rate the stock:

Further M&A: Vitec ended 2025 with SEK 416 million in cash and lot’s of credit (SEK 1.18 billion unutilized) plus a SEK 1 billion bond capacity. The slowdown in acquisitions in H2 2025 provide lot’s of dry powder. We can expect Vitec to deploy this capital in 2026 with the lower valuations on the market. The recent acquisitions of Infometric (Sweden, Feb 2026) and Autonet (Netherlands, Jan 2026) confirm this.

The “AI Efficiency” Kick: If Vitec successfully deploys tools like Claude Code, mentioned in the 2024/2025 company reports, across its 46 development teams, we can expect a structural reduction in R&D efforts (currently ~11-13% of sales capitalized). A 20% efficiency gain here would flow directly to the bottom line, restoring margins to the >30% target.

The problem is that customers knows about the lower costs for R&D and software maintenance with the latest cutting edge tools, and they will use this information to negotiate. This is a tricky situation.The Fading Data Moat Effect: We need to monitor closely, if Vitec will be able to adopt the SoR argument and deploy niche and domain specific workflow automation to drive costs down. This maybe leads to the “Death of the Seat” argument. Operating companies need far less licences if lot’s of tasks are automated, leading to fewer software licences. That drives us automatically to an article, I wrote explicitly about this topic. It’s key to understand the upcoming challenges‼️

Note: You can’t just fix some code in your existing software to adopt to these challenges. It needs a Agentic AI native strategy, aka called refactoring your application core tech stack, perfectly executed, on dozens of Business Units and even more companies. This is no easy task. It’s not just using tools like Claude Code and push the “generate code button”, we’re talking about fundamental changes in organisations. I’ve seen some very early Proof of Concepts in real life, and it scared me.

On the next slide, direct the attention to the workforce mode. When I lately updated my own CV, I’ve realized that I’m also in this T-shaped profile, which means deep technical understanding in some areas in always having a exe on the big picture combination, aka. management tasks. Exciting times.

Source: My Kinsey & Company.

Reverse-FOMO: The market has sold off software stocks on AI fears. If Vitec reports Q1 2026 numbers showing steady retention and organic growth (proving AI hasn’t already killed them), the reversal of this sentiment could drive significant multiple expansion. We can witness meaningful insider buys in February 2026 (scroll down). This needs to be further observed. Looks like Vitec’s management has confidence in their own execution strategy.

8. Management

Evaluation:

Olle Backman (CEO): Backman has proven to be a transparent and “sober” leader. He addressed the margin compression in 2025 without resorting to financial engineering to hide it. His focus on “Cash EBIT” aligns with shareholder interests.

Track Record: Since 2019, the team has delivered a sales CAGR of ~22% and FCFE CAGR of ~28%. They have successfully mastered the COVID-19 crisis and the 2022 inflation spike.

Capital: The decision to issue equity in Sept 2024 (SEK 1.1 billion raise) was timed well, bolstering the balance sheet before a potential M&A spree.

Insider Shares: The founders (Stenlund/Sandberg) hold significant voting power (A-shares) and equity, ensuring they think in decades.

The “Discounted Future” Question:

Is the earlier valuation (P/E ~43x based on 2025e) justified?

The market priced in ~15-18% earnings growth.

Organic Growth (5-7%): Realistic given CPI escalators and module upsells.

M&A Growth (10-12%): Realistic given the fragmented European market and available capital.

Margin Expansion: Required to meet the old valuation. Management must fix the 2025 margin dip. If margins stay at 26%, the stock is way too expensive.

With the recent decline in stock price, Mr Market offers us maybe a rare chance to step in with discount even the margins got short term fixed to < 30%.

9. Who owns Vitec and What Drives the Stock?

The shareholder registry is dominated by long-term institutional capital, providing stability but limiting float.

Top Holders are SEB Investment Management (5.06%), Cliens Kapitalförvaltning (5.0%), Capital Group (4.7%).

The Bulls see Vitec as a “Compounder” with an infinite runway in Europe, insulated from AI by regulation.

The Bears see “SaaSpocalypse,” falling margins, and a valuation disconnect. They argue VMS moats are shallower than believed.

Short Interest are typically low, but tactical shorting has increased around earnings dates.

10. Three Future Scenarios (5-Year Plan)

Scenario A: The AI Compounder (Base Case - 50% Probability)

AI agents (Claude Code, etc.) become productivity tools for Vitec, not replacements of Vitec. Vitec integrates AI into its products (e.g., AI-driven energy forecasting in Enova/Trinergy), allowing for price increases.

5-Year Plan:

2026: Margins recover to 28%. M&A pace: 6-8 deals.

2027: Expansion into DACH (Germany). Revenue hits SEK 5bn.

2028-2030: Vitec creates a data layer across its verticals, monetizing anonymized industry insights.

Result: Stock compounds at 10-15% annually.

Scenario B: The SaaS Stagnation (Bear Case - 30% Probability)

AI lowers the barrier to entry. New startups clone Vitec’s niche software for fractions of the cost. Churn rises from <5% to 10%. Margins stay compressed at 24-25% due to pricing pressure.

5-Year Plan:

2026: Organic growth falls to 0-2%.

2027: Vitec halts M&A to defend existing turf. Cost-cutting programs (headcount reduction).

2028-2030: Dividend stagnates. Multiple contracts to 15-20x P/E.

Result: Dead money. Stock underperforms the index.

Scenario C: The Consolidator (Bull Case - 20% Probability)

The “SaaSpocalypse” crushes private valuations. Vitec uses its strong balance sheet to buy high-quality companies at “fire sale” prices (5-6x EBITA). It aggressively enters new geographies (Poland, France, UK).

5-Year Plan:

2026: 10+ Acquisitions. Revenue growth >25%.

2027: Margins hit 32% as scale efficiencies kick in.

2028-2030: Vitec joins the “Large Cap” elite in Europe, becoming a must-own stock for global funds.

Result: Stock multiplies long-term.

10. My Conclution

Does Vitec take the lead, like the Bison does? Does Vitec’s software directly face the storm and use the AI and the ”System of Action” approach?

The “Cash” Truth: While accounting profits (EBITA) had some ups and downs in 2025 due to technical stuff, Operating Cash Flow went up by 17%. Vitec is a cash-generating machine, but the market is currently pricing it below its true value because of margin noise.

The Moat is “Boring”: Vitec’s verticals (Pharmacy, Grid, Church, Health) are protected by regulatory moats and “data creation” sovereignty, which are resistant to generic AI disruption.

Dry Powder: With over 2 billion SEK in liquidity, Vitec is ready to speed up M&A in a buyer-friendly market. The acquisitions of NMG and Infometric in early 2026 signal this already.

Dividend Signal: They’re planning to raise the dividend 2% to SEK 3.68, which would be the 23rd year in a row they’ve increased it. This shows that the company’s management team has a lot of confidence in the company’s cash stability.

Relative Value: When you compare Vitec to Constellation Software, you’ll see that they have a longer runway for compounding, and they’re valued similarly.

Why Now?

The market is pretty worried about AI, calling it the “SaaSpocalypse.” This has compressed multiples for software consolidators. Vitec’s particular set of assets is particularly defensive. If you get in now, you can buy a top-notch compounder at a discount, with the chance to recover as the “AI threat” story becomes more commonplace and Vitec’s profit margin growth resumes in late 2026.

Additional Sources:

https://go-techsolution.com/anthropic-claude-cowork-how-a-new-ai-tool-shook/

https://medium.com/@kannankannan18/anthropics-plugins-trigger-the-saaspocalypse-14fe24ec55e7

vitec-software-group-2025-q4-eng.pdf

Vitec_Software_Group_2024_Q3_English

vitec-software-group-annual-report-2024.pdf

vitec-software-group-2025-q3-english.pdf

vitec-software-group-interim-report-january-march-2025.pdf

vitec-software-group-2025-q2-english.pdf

vitec-software-group-2024-q2-english.pdf

vitec_software_group_2024_q4_english.pdf

Vitec Software Group 2024 Q1 English

https://s3-eu-west-1.amazonaws.com/rdey-cms-prod/app/uploads/2025/02/vitec-q4-2024-update2.pdf

https://www.bain.com/insights/will-agentic-ai-disrupt-saas-technology-report-2025/

https://www.fjordalpha.com/p/vitec-software-a-swedish-constellation/comments

https://dev.to/alexmercedcoder/ai-development-heats-up-week-of-january-27-february-2-2026-3dgd

https://medium.com/techacc/vertical-ai-agents-are-eating-software-60e6b4f41f90

https://view.news.eu.nasdaq.com/view?id=b057b8010bf8a6db7cf7e9ee7fe595ec0&lang=en&src=micro

https://simplywall.st/stocks/se/software/sto-vit-b/vitec-software-group-shares/ownership

https://www.investing.com/equities/vitec-b-consensus-estimates

https://inpractise.com/articles/constellation-software-and-proprietary-manda-sourcing

https://portersfiveforce.com/blogs/competitors/vitecsoftware

https://storage.mfn.se/99ec9bb5-d9d3-42e3-b841-8d6179623226/vitec-software-group-2025-q2-english.pdf

https://portersfiveforce.com/blogs/growth-strategy/vitecsoftware

https://evrimagaci.org/gpt/anthropic-unveils-claude-opus-46-amid-ai-industry-shakeup-527149

https://dpr648.medium.com/the-role-of-ai-in-redefining-vertical-software-3003e07aa50a

https://www.insightpartners.com/ideas/building-a-moat-in-the-age-of-ai/

https://www.vendep.com/post/forget-the-data-moat-the-workflow-is-your-fortress-in-vertical-saas

https://stockunlock.com/stockDetails/VIT%20B.ST/insider/insiderTransactions

https://research.cbs.dk/en/studentProjects/valuation-of-vitec-software-group/

https://www.reworked.co/collaboration-productivity/anthropic-adds-plugins-to-claude-cowork/

https://www.youtube.com/c/DanielPronk

https://simplywall.st/stocks/us/software/otc-vitb.f/vitec-software-group/future

https://beancount.io/blog/2026/02/02/vertical-saas-survival-guide-competing-against-ai-giants

https://www.bvp.com/atlas/building-vertical-ai-an-early-stage-playbook-for-founders

https://www.signalfire.com/blog/vertical-ai-in-trades-and-construction

https://www.mckinsey.com/capabilities/quantumblack/our-insights/seizing-the-agentic-ai-advantage

I cant find the symbol tp do further research - Can you provide the symbol please? It says VITBF but I cant find that on any of the US exchanges? Very interesting company - You obv prefer this to CSU but what abt against Chapters or ROP or Tyler?

This is an excellent, well-researched post. I mean, 50 footnotes is more than I will probably ever have! I liked it, and I will need to digest it and re-read it later - it's a lot to think about, in a good way.

The most thoughtful (or not) I have to say, is about technological shifts. It's all about whether it's a "Video killed the radio star" scenario or not. That happened as predicted in the song, and was easy to see. But I don't think "Nvidia (Claude) killed the VMS star (Vitec)" is a good title or prediction. No, I don't believe that will happen, it's a simplification, and not that logical. Overall, Vitec have a strong moat.